Indian banks' systemic deposit growth gain momentum but NIM likely to dip 30bps (YoY): Report

ANI

10 Jul 2025, 08:28 GMT+10

New Delhi [India], July 10 (ANI): The Indian banking sector is witnessing a steady pickup in deposit growth, but banks are likely to report a decline in their net interest margins (NIM) in the first quarter of FY26, according to a report by Phillip Capital.

The report noted that systemic deposit growth is gaining momentum, helping improve the credit-to-deposit ratio. Based on business updates released so far, the overall credit growth stands at 0.4 per cent on a sequential basis.

It stated 'banking universe will see 1 per cent yoy (-1.5 per cent qoq) growth in NII. Sector NIM will decline 10bps qoq /30bps yoy as cost of funds remains stable'

The report highlighted muted growth in Net Interest Income (NII) across the banking sector due to weak credit expansion. Overall NII is projected to grow just 1 per cent year-on-year (YoY) and decline by 1.5 per cent QoQ.

Sector-wide NIM is expected to decline by 10 basis points (bps) QoQ and 30bps YoY as the cost of funds stays largely stable and returns from repo-linked loans decline.

However, it also noted that the private sector banks have shown stronger performance with loan growth of 0.5 per cent quarter-on-quarter (QoQ) and deposit growth of 1.3 per cent QoQ. As a result, their credit-to-deposit ratio stands at 92 per cent, reflecting a decline of 0.8 per cent QoQ.

In contrast, public sector banks (PSBs) posted a modest 0.2 per cent QoQ loan growth, while their deposit levels remained flat. The credit-to-deposit ratio for PSBs remained stable sequentially at 78%.

Private banks are likely to record a 1.9 per cent YoY decline and a 0.8 per cent QoQ drop in NII. Meanwhile, PSBs may witness a 0.3 per cent YoY decline and a sharper 2.4 per cent QoQ fall in NII.

On the profitability front, banks are expected to report modest growth in profit after tax (PAT), supported by lower credit costs.

Overall PAT is forecast to grow 3.5 per cent YoY and 0.8 per cent QoQ. Among segments, PSBs may post a 7 per cent YoY rise in PAT but a 4.1 per cent QoQ decline, while private banks could register 1.4 per cent YoY and 4.2 per cent QoQ growth.

Credit costs are seen normalizing, aided by improving asset quality. The report estimated credit cost at 59bps for Q1FY26, down from 64bps in Q4FY25 but up from 52bps in Q1FY25.

The report outlined that while the deposit momentum is positive, the pressure on margins and core earnings will be a key watchpoint for the banking sector in the upcoming quarterly results. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New Zealand Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New Zealand Star.

More InformationBusiness

SectionU.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

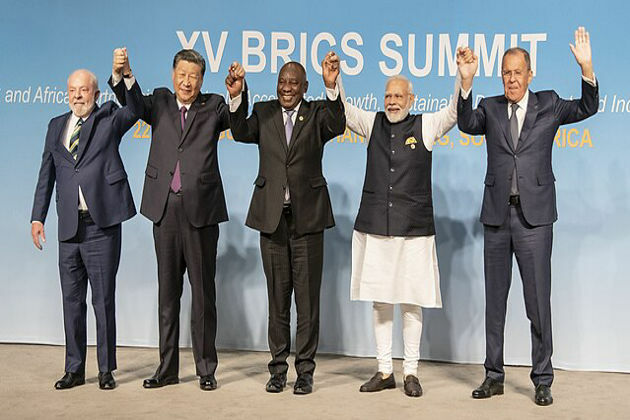

BRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...

BP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...

FedEx, UPS step up as Canada Post loses market share in strikes

OTTAWA, Canada: With Canada Post struggling to maintain operations amid labour unrest, rivals like FedEx and UPS are stepping in to...

U.S. stocks steady Tuesday despite tariffs turmoil

NEW YORK, New York - U.S. and global markets showed a mixed performance in Tuesday's trading session, with some indices edging higher...

Business

SectionU.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

BRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...

BP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...

FedEx, UPS step up as Canada Post loses market share in strikes

OTTAWA, Canada: With Canada Post struggling to maintain operations amid labour unrest, rivals like FedEx and UPS are stepping in to...

U.S. stocks steady Tuesday despite tariffs turmoil

NEW YORK, New York - U.S. and global markets showed a mixed performance in Tuesday's trading session, with some indices edging higher...